SOONPAY

Competitive Analysis

Market Research & Strategic Positioning for Africa's Next-Gen Remittance Platform

Executive Summary

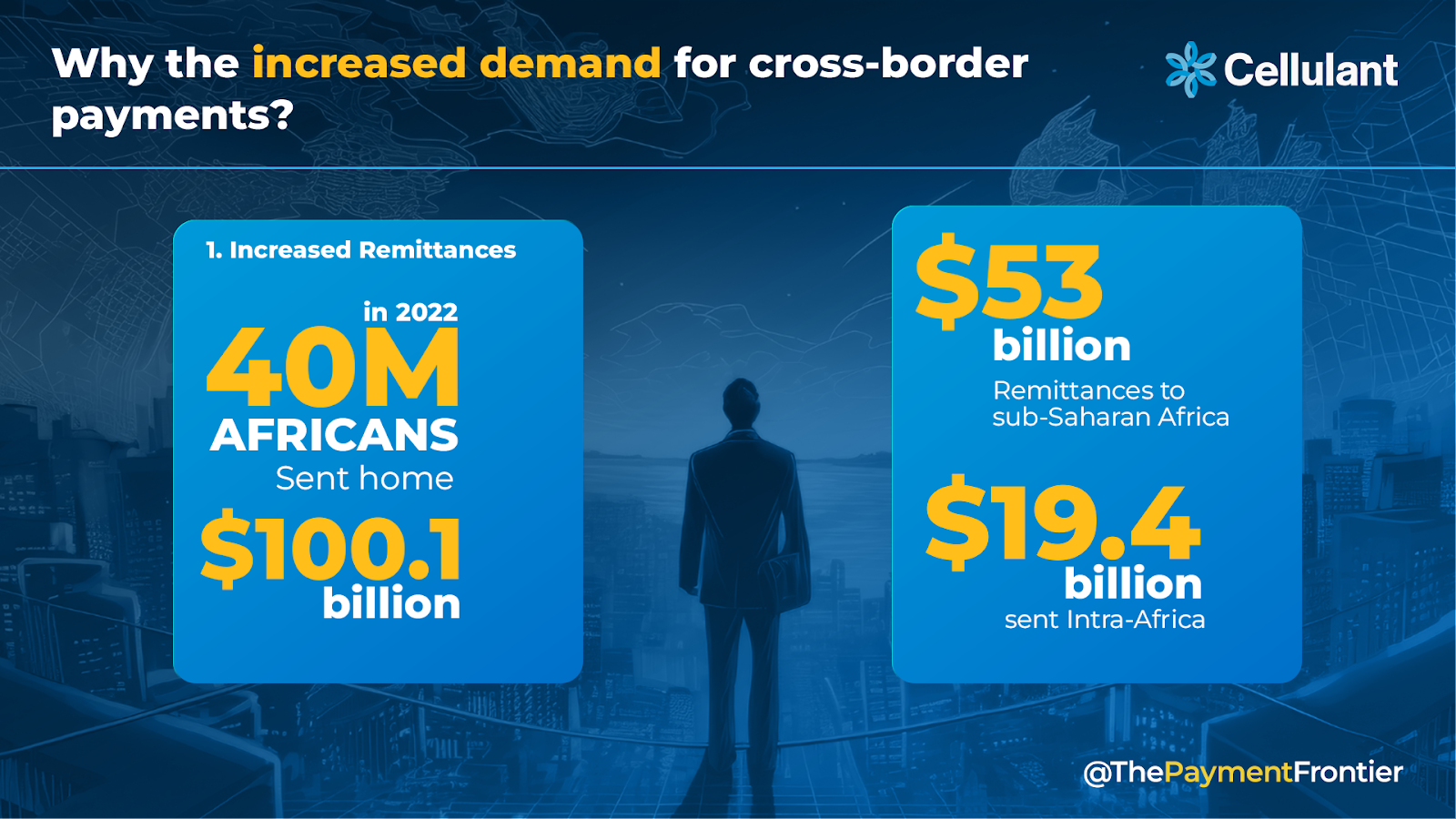

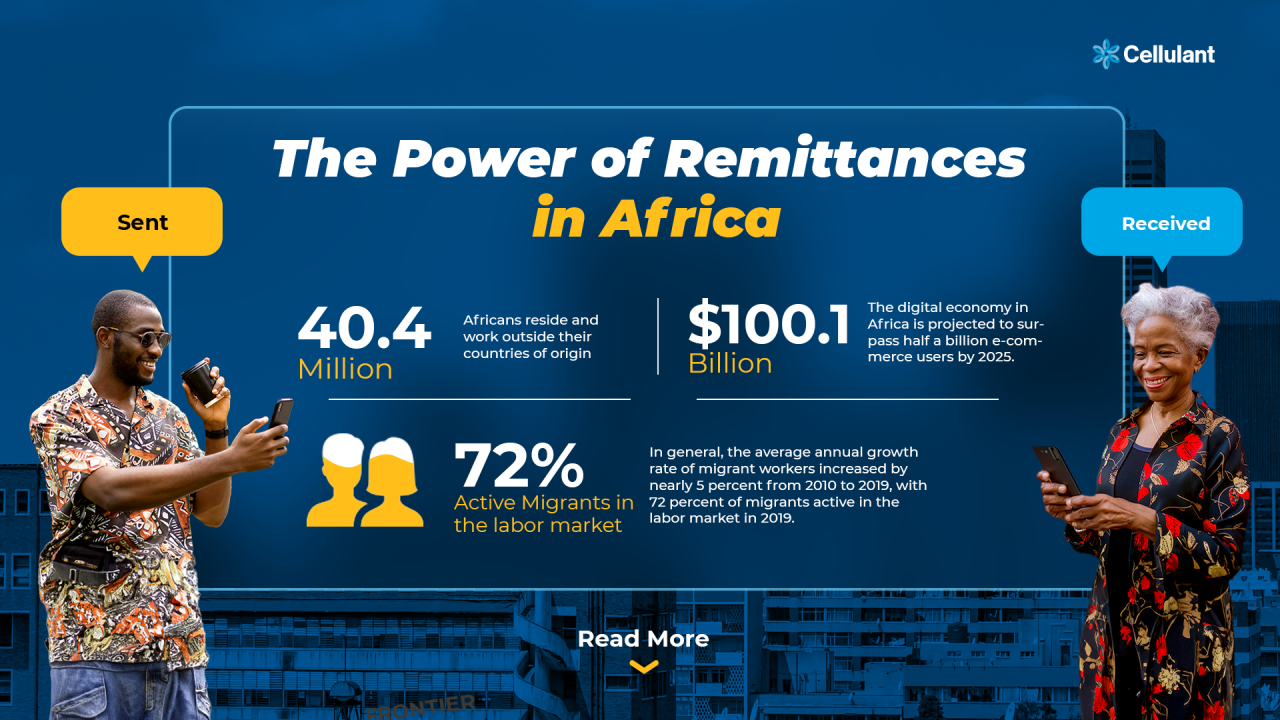

The African remittance market is experiencing explosive growth with multiple players competing on fees, speed, and coverage. SOONPAY has a unique opportunity to differentiate through transparency, comprehensive coverage, and superior user experience.

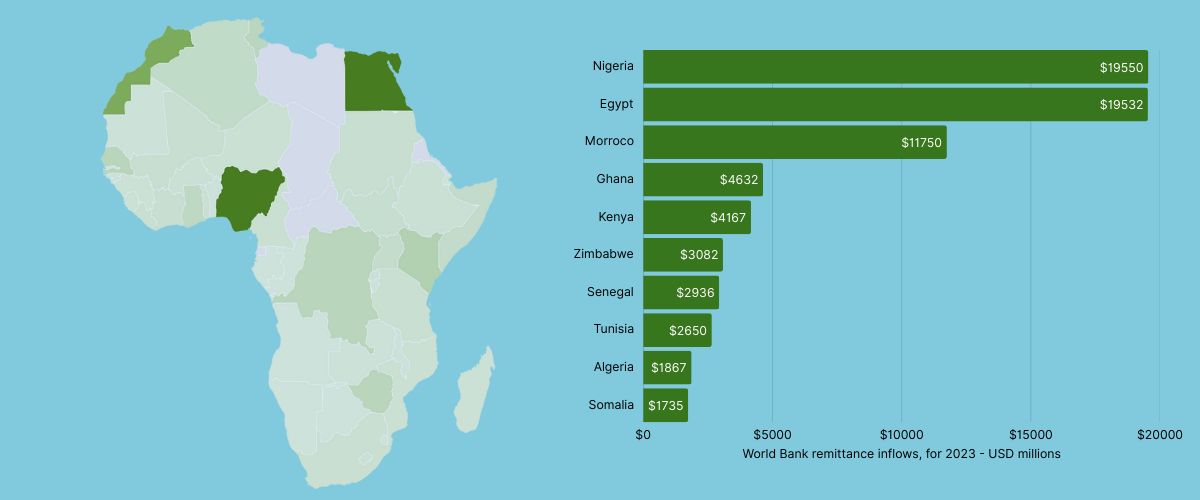

Market Size

$100B+

Key Competitors

25+

Growth Rate

15% CAGR

Target Corridors

50+

Comprehensive Competitor Analysis

| Competitor | Origin Countries | Destination Coverage | Fee Structure | Payout Methods | Speed | Key Features | Weaknesses |

|---|---|---|---|---|---|---|---|

| LemFi | Europe, North America | Africa-wide + global | "Low fees" messaging | Bank, Mobile Money | Instant - Minutes | $1B+ monthly volume, Multi-currency accounts | Limited transparency on FX rates |

| NALA | US, UK, EU | 11 African countries | "No charges" + FX margin | Mobile Money, Bank | Near-instant | Apple/Google Pay, Real-time FX | Limited corridor breadth |

| Sendwave | US, UK, Canada, EU | Kenya, Nigeria, Ghana, etc. | "No fees" + FX markup | Mobile, Bank, Cash | Instant (mobile) | Mobile-first, Strong brand | Hidden FX costs, Regulatory issues |

| Yellow Card | Global (crypto-based) | 20+ African countries | "Free" + stablecoin spreads | Mobile Money, Bank | Minutes | Stablecoin-powered, Visa partnership | Crypto complexity, Regulatory risks |

| Wave | Regional (West Africa) | Senegal, Côte d'Ivoire, Mali | Very low fees | Mobile Money primarily | Instant | Bill pay, Ecosystem play | Limited geographic scope |

| Chipper Cash | US, UK + Intra-Africa | 21+ African countries | "No fees" + FX margin | Wallet, Bank | Instant - Minutes | P2P focus, Investment features | FX transparency, Varying limits |

| Mukuru | Europe, SA | 20+ African countries | Low cost + agent fees | Cash, Mobile, Bank | Varies by method | 300k+ agent network | Higher overhead, Regional skew |

| Afriex | US, UK, Canada | Nigeria, Ghana, Kenya, Uganda | $1 flat or "zero fees" | Wallet, Bank | Instant | Dual-currency wallet | FX margin play, Limited corridors |

| WorldRemit | 50+ countries | 130+ countries | Clear fees + FX markup | Mobile, Bank, Cash | Minutes - Days | Wide coverage, Established | Higher total cost, Dated UX |

| Remitly | 17 countries | 100+ countries | Tiered fees + FX | Mobile, Bank, Cash | Express/Economy options | Delivery guarantee, Promos | Post-promo costs high |

| Wise | Global | 80+ countries | Transparent fee + mid-market rate | Bank, some Mobile | 1-2 days typically | Best FX transparency | Limited Africa payouts |

| Pesabase | Global | South Sudan, East Africa | "90% lower than traditional" | SIM/Mobile, Agents | Instant | Blockchain rails, Local focus | Very limited coverage |

| Eversend | Uganda base + diaspora | Kenya, Uganda, Ghana, Nigeria | "Drive fees to zero" | Wallet, Bank | Near-instant | Multi-currency wallet | Hidden costs at FX |

| Grey | Global | Africa + LATAM/SEA | FX-focused pricing | Multi-currency wallets | Instant for some rails | Freelancer focus | Niche positioning |

| Nsano | Ghana, UK | 30+ countries | Aggregator pricing | Mobile Money, Cards | Growing network | Payment infrastructure | More B2B than B2C |

| Yogupay | Global | Cross-border Africa | Transparent pricing | Real-time settlement | Real-time | 24/7 support, Security focus | Brand awareness |

| M-Pesa | Kenya origin | Kenya, Tanzania, Mozambique, Ghana | Transaction fees vary | Mobile money, Agent network | Instant | Pioneer in mobile money, Extensive agent network | Limited to specific countries |

| Paga | Nigeria base | Nigeria + expanding Africa | Transaction-based fees | Agent network, Mobile, Bank | Instant - Minutes | Large agent network, Bill payments | Nigeria-centric |

| EcoCash | Zimbabwe | Zimbabwe primarily | Transaction fees | Mobile money, Bank integration | Instant | Market leader in Zimbabwe | Single country focus |

| Flutterwave Send | US, Canada + Africa | Africa-wide | Flat low fee varies by country | Bank, Mobile money | Instant delivery | Strong payment rails, Enterprise backing | Consumer brand perception |

| SOONPAY (Positioning) | US, UK, Canada, EU | All major African markets | Transparent fee + live FX rate | Mobile, Bank, Cash | Instant to wallets | Rate lock, Bill pay, Loyalty program | New entrant (build trust) |

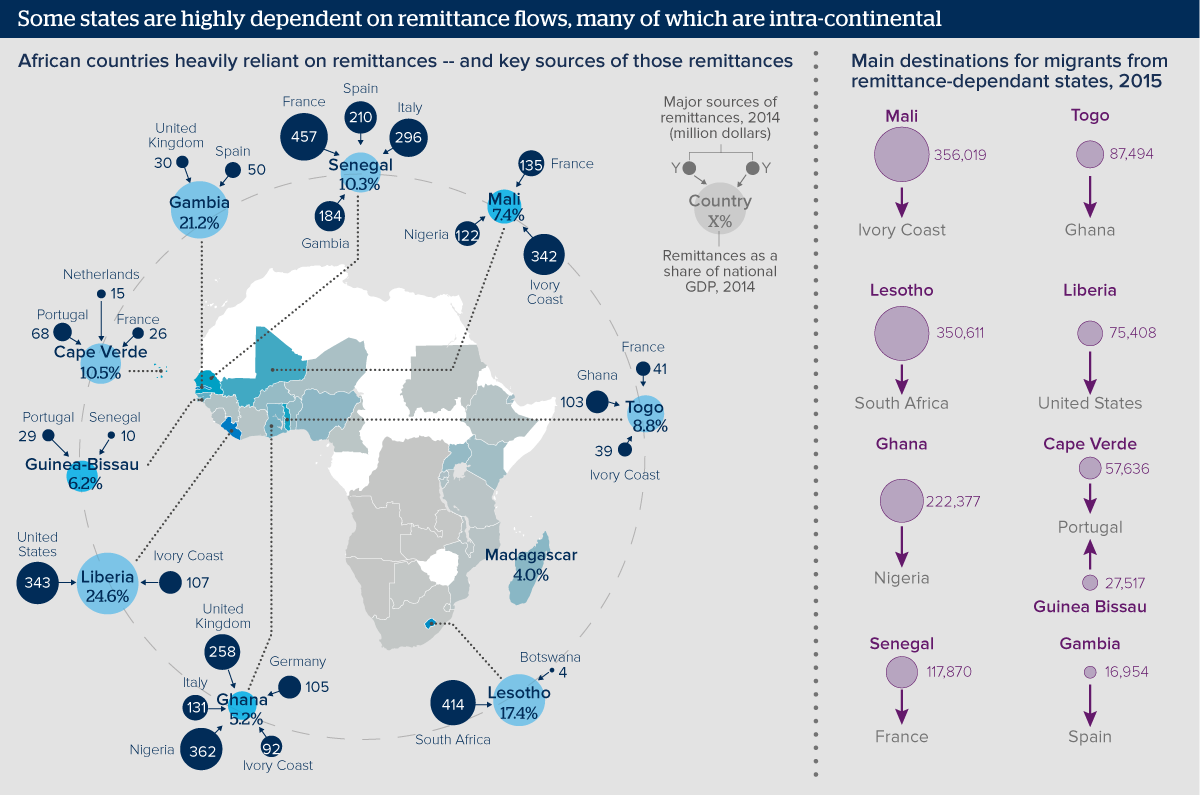

Intra-Africa Money Transfer Landscape

While diaspora remittances dominate, intra-Africa transfers are growing rapidly with unique players focusing on cross-border African payments:

Mobile Money Leaders

- M-Pesa: The pioneer with 50M+ users across East Africa, enabling instant cross-border transfers within its network

- EcoCash: Dominant in Zimbabwe with partnerships for regional expansion

- MTN Mobile Money: Present in 17 African countries with interoperability initiatives

Pan-African Digital Players

- Chipper Cash: Free P2P transfers across 21+ African countries

- Wave: Focused on francophone West Africa with ecosystem approach

- Paga: Nigerian powerhouse expanding across West Africa

Enterprise-Backed Solutions

- Flutterwave: B2B strength leveraging into consumer remittances

- Yogupay: Real-time settlement focus with security emphasis

SOONPAY's Competitive Advantages

Core Value Proposition

"More of your money gets home - with complete transparency, instant delivery, and no hidden fees"

1. Radical Transparency

- Show live mid-market rate + exact margin

- Display recipient's exact amount before sending

- Rate comparison widget vs competitors

- "What you see is what they get" guarantee

2. Superior Coverage

- All major diaspora origins (US/UK/CA/EU)

- Comprehensive Africa coverage

- Multiple payout options per country

- Underserved corridor focus

3. Speed & Reliability

- Instant to mobile wallets (M-Pesa, MTN, Airtel)

- Same-day bank deposits

- 99.9% uptime guarantee

- 24/7 human support

4. Modern Tech Stack

- Stablecoin rails (hidden complexity)

- Fiat-native user experience

- Rate lock feature

- Multi-currency wallets

5. Recipient Value-Add

- Free bill payment

- Airtime/data top-ups

- Loyalty rewards program

- Financial education content

6. Trust & Compliance

- Full regulatory compliance

- Clear dispute process

- Insurance on transfers

- Local partnerships

Marketing Campaign Strategy

Focus on transparency, family connection, and financial empowerment

Target Audience Segments

- Primary: African diaspora professionals (25-45) in US/UK/Canada sending regular support

- Secondary: Recipients in Africa who influence sender choice

- Tertiary: Community organizations, churches, cultural associations

Campaign Phases

Phase 1: Awareness & Trust Building (Weeks 1-4)

- Launch brand video: "The truth about remittance fees"

- Influencer partnerships with diaspora creators

- PR campaign on transparency standards

- Community organization partnerships

Phase 2: Acquisition Drive (Weeks 5-12)

- Performance marketing on Meta/Google/TikTok

- Referral program launch ($10 for referrer, $5 for recipient)

- Country-specific campaigns with localized creative

- First transfer guarantee (refund if not satisfied)

Phase 3: Retention & Growth (Week 13+)

- Loyalty program (fee rebates for regular senders)

- Recipient engagement features (bill pay, top-ups)

- Success story content marketing

- Expansion announcements for new corridors

Channel Strategy

Digital Performance (40% budget)

Meta ads targeted by diaspora origin + destination, Google Search/Display, TikTok for younger diaspora

Community & Influencers (25% budget)

Church partnerships, cultural associations, micro-influencers in diaspora communities

Referral Incentives (20% budget)

Both-sided rewards, tiered bonuses for multiple referrals, recipient activation bonuses

Content & PR (15% budget)

SEO content, PR on transparency, success stories, financial education content

Key Messaging Framework

Primary Messages

- "See the real rate. Pay the real price. Your family gets the real amount."

- "From your phone to their mobile money in minutes, not days"

- "We show our math - no hidden fees, no surprises"

- "Built for Africa, trusted by the diaspora"

Competitive Positioning Lines

- vs "No Fee" competitors: "They say no fees but hide it in the rate. We show you everything."

- vs Legacy players: "Why pay 2005 prices for 2025 technology?"

- vs Crypto players: "Modern rails, familiar experience. No crypto complexity."

- vs Limited coverage: "One app for all of Africa. Every country, every wallet."

Success Metrics & KPIs

Customer Acquisition

CAC < $25

Activation Rate

KYC → 1st Transfer: 40%

Retention

Monthly Active: 60%

Referral Rate

30% of users refer

Monthly Tracking

- Total transfer volume

- Average transfer value

- Corridor performance (volume by route)

- Payout method distribution

- Customer satisfaction (NPS)

- Support ticket resolution time

- Competitor rate comparison clicks

Implementation Roadmap

- Finalize rate comparison widget for website

- Create landing pages for top 5 corridors

- Set up tracking pixels and analytics

- Brief creative agency on brand campaign

Next 30 Days

- Launch beta with select diaspora communities

- Implement referral program infrastructure

- Partner with 3-5 diaspora influencers

- Create comparison content vs top 3 competitors

- Set up customer support team and knowledge base

- Develop recipient-side mobile app features

- Establish partnerships with mobile money operators